Ab payroll calculator

View the Demo Today. Heres a step-by-step guide to walk you through.

2015 Alberta Wcb Rate Calculator

It will confirm the deductions you include on your.

. Features That Benefit Every Business. Get Started With ADP Payroll. Discover The Most Intuitive Client-Driven Solution.

Ad Payroll Made Easy. Discover ADP Payroll Benefits Insurance Time Talent HR More. If you make 52000 a year living in the region of Alberta Canada you will be taxed 15602.

Use our payroll calculator to see how much your organization could be saving. Time and attendance software with project tracking to help you be more efficient. Ad Process Payroll Faster Easier With ADP Payroll.

The tool then asks you. You can use the calculator to compare your salaries between 2017 and 2022. The average income in Alberta for adults over the age of 16 is 58000.

This compares to an average of 48700 and 38800 median in. Enter excess Insurance if known. Enter amount of any Trainee Awards.

Time and attendance software with project tracking to help you be more efficient. Ad No more forgotten entries inaccurate payroll or broken hearts. Form TD1-IN Determination of Exemption of an Indians Employment Income.

Ad No more forgotten entries inaccurate payroll or broken hearts. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Payroll Deductions Online Calculator.

That means that your net pay will be 36398 per year or 3033 per month. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Based Specialists Who Know You Your Business by Name.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Ad Compare This Years Top 5 Free Payroll Software. The calculator is updated with the tax rates of all Canadian provinces and.

Enter your Earnings here Ex. All Services Backed by Tax Guarantee. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program.

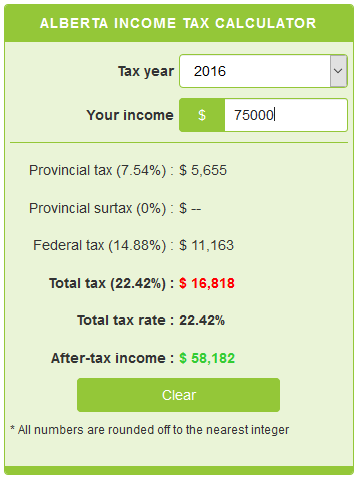

2022 free Alberta income tax calculator to quickly estimate your provincial taxes. You first need to enter basic information about the type of payments you make. That means that your net pay will be 40568 per year or 3381 per month.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Ad Calculate your savings with our Payroll Administration solutions calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Free Unbiased Reviews Top Picks. AB Pay Roll Your Partner for Success. The tool will convert that hourly wage into an annual salary.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Federal Salary Paycheck Calculator. Ad Quickly Easily Confidently Pay Employees from Wherever You Are.

The Alberta Income Tax Salary Calculator is updated 202223 tax year. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. Ad Payroll So Easy You Can Set It Up Run It Yourself.

How to use a Payroll Online Deductions Calculator. ABP AB Payroll is a Outsource Payroll Services firm offering payroll processing expertise tax compliance consulting and managed payroll. Plug in the amount of money youd like to take home.

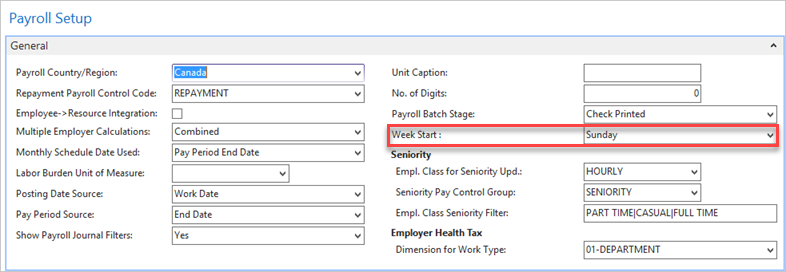

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Annual salary average hours per week hourly rate 52 weeks minus weeks of vacation - weeks of holidays For example. The online calculator makes it easier to.

Were making it easier for you to. This works out to be 2231 per biweekly paycheck. Salary commission or pension.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Post Doc Employee 21. For your 2022 payroll deductions you can use our Payroll Deductions Online Calculator PDOC.

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Bc 100 Authentic 45 Off Growandglow In

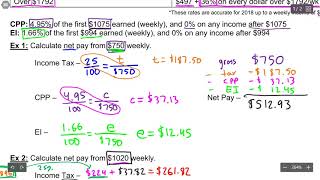

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Payroll Calculator Free Employee Payroll Template For Excel

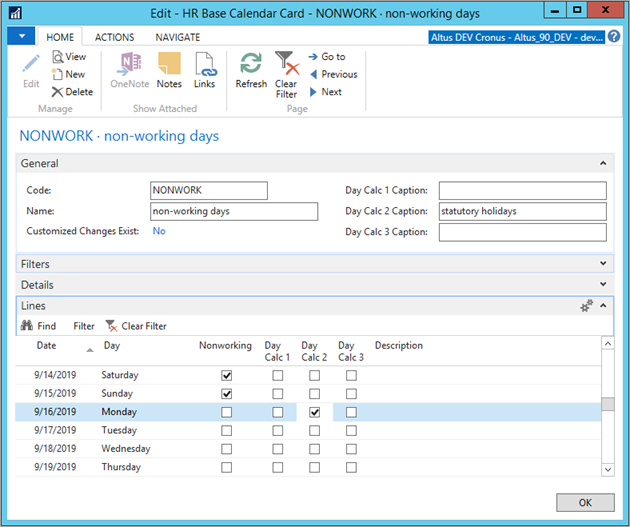

Ka 02262 Customer Self Service

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Payroll Deductions In Alberta Canada Simplified Weekly Income Tax Cpp And Ei Explained Youtube

Salary Calculator Singapore In 2022 Pay Calculator Salary Calculator Salary

As A Canadian Minimum Wager I Pay 3 Out Of 15 I Earn Per Hour Into Taxes How Much Of This Will I Get Back In The Future In Some Form Rrsp Quora

Payroll Calculator With Pay Stubs For Excel

Global Payroll Calculator

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Federal Tax Calculator Best Sale Save 31 Srsconsultinginc Com

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Ka 02262 Customer Self Service

Payroll Calculator With Pay Stubs For Excel